ซื้อหวยออนไลน์เว็บไหนดี 10 เว็บแทงหวย888 เชื่อถือได้ จ่ายจริง 2568

การซื้อหวยออนไลน์กลายเป็นอีกหนึ่งทางเลือกยอดนิยมของคนไทยที่ชื่นชอบการเสี่ยงโชค แต่หลายคนอาจยังสงสัยว่า ควรเลือกซื้อหวยออนไลน์เว็บไหนดี ที่ทั้งปลอดภัย เชื่อถือได้ และให้ผลตอบแทนคุ้มค่า โดยเฉพาะหวยยอดฮิตอย่าง หวยลาว หวยฮานอย หวยหุ้น หรือหวยยี่กี บทความนี้จะพาคุณไปรู้จักกับ 10 เว็บหวยออนไลน์ชั้นนำที่ได้รับความนิยมสูงสุดในปัจจุบัน แต่ละเว็บมีจุดเด่นที่แตกต่าง ไม่ว่าจะเป็นอัตราจ่ายที่สูงถึงบาทละ 1,000 การให้บริการหวยหลากหลายประเภททั้งไทยและต่างประเทศ เช่น หวยรัฐบาล หวยออมสิน หวยธ.ก.ส. หวยลาว หวยฮานอย หวยมาเลย์ หวยหุ้น และหวยยี่กีที่ออกรางวัลหลายรอบต่อวัน นอกจากนี้ บางเว็บยังเน้นระบบฝาก-ถอนที่รวดเร็ว มีขั้นต่ำในการใช้งานที่เข้าถึงง่าย และมาพร้อมโปรโมชั่นที่ดึงดูดใจ ตอบโจทย์ทั้งคอหวยมือใหม่และนักเสี่ยงโชคประจำที่มองหาความสะดวกและความคุ้มค่าในการแทงหวยออนไลน์อย่างแท้จริง

ซื้อหวย365

- หวยชุดที่มีอัตราจ่ายสูงสุด 120,000 บาท

- ระบบแนะนำเพื่อนรับค่าคอมมิชชั่นสูงสุด 8%

- เริ่มฝากเงินขั้นต่ำเพียง 20 บาท

77Lotto

- ไม่มีการกำหนดขั้นต่ำในการฝากเงิน เริ่มฝากได้ตั้งแต่ 1 บาทขึ้นไป

- ระบบแนะนำเพื่อนรับค่าคอมมิชชั่นสูงสุด 8%

- มีทั้งหวยออนไลน์และเกมเดิมพันคาสิโนออนไลน์ให้เลือกเล่น

Huaysod

- มีหวยลาวชุด อัตราจ่ายสูงสุด 90,000 บาท ให้เลือกซื้อ

- มีหวยฮานอยให้เลือกซื้อหลากหลายประเภท

- มีอัตราจ่ายสูงสุดของหวยออนไลน์ 950 บาท

Confirm168

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

- สามารถเลือกซื้อหวยออนไลน์และเล่นเกมเดิมพัน

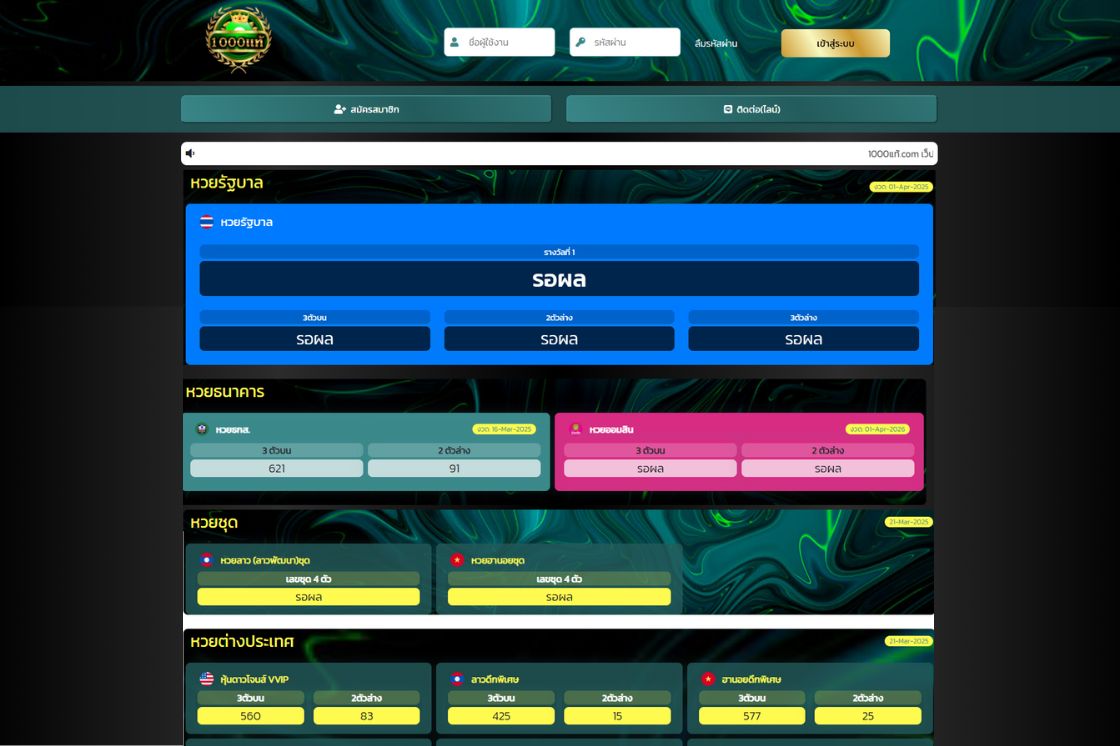

1000แท้

- อัตราจ่ายของหวยออนไลน์สูงสุด 4,000 บาท สำหรับ 4 ตัวบน

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

Tong998

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- มีหวยฮานอยให้เลือกซื้อ 11 ประเภท หวยลาว 14 ประเภท

- มีทั้งหวยออนไลน์และเกมเดิมพันคาสิโนออนไลน์ให้เลือกเล่น

ใจดี24

- อัตราจ่ายของหวยออนไลน์สูงสุด 4,000 บาท สำหรับ 4 ตัวบน

- อัตราจ่ายของหวยออนไลน์สูงสุด 1,000 บาท สำหรับ 3 ตัวบน

- เริ่มซื้อหวยออนไลน์ได้ง่าย เริ่มฝากขั้นต่ำเพียง 50 บาท

Lottoone

- หวยชุด มีโอกาสรับรางวัลสูงถึง 120,000 บาท

- วงล้อมหาสนุกมีรางวัลสูงสุดถึง 10,000 บาท

- มีโปรโมชั่นโบนัสประจำวันให้กับสมาชิก

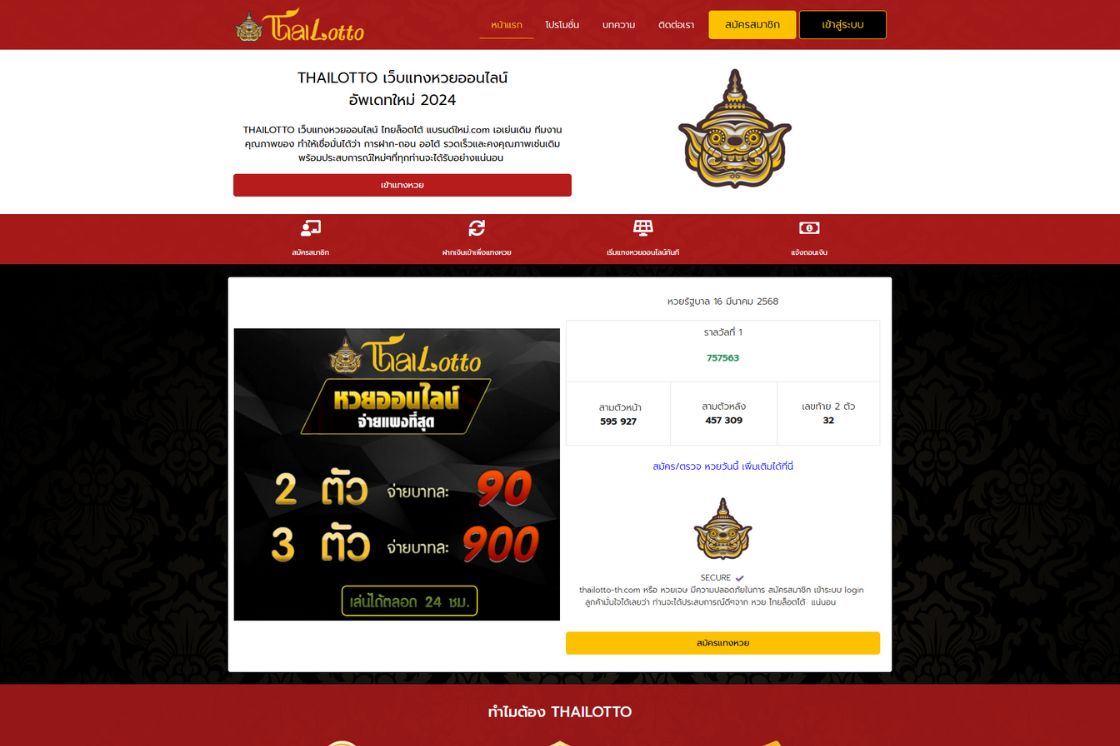

Thailotto

- หวยลาวชุดที่มีอัตราจ่ายสูงถึง 120,000 บาท

- หวยแจ๊คพอตที่ลุ้นรับเงินรางวัลสูงถึง 400,000 บาท

- วงล้อนำโชคที่มีเงินรางวัลสูงสุด 100,000 บาท

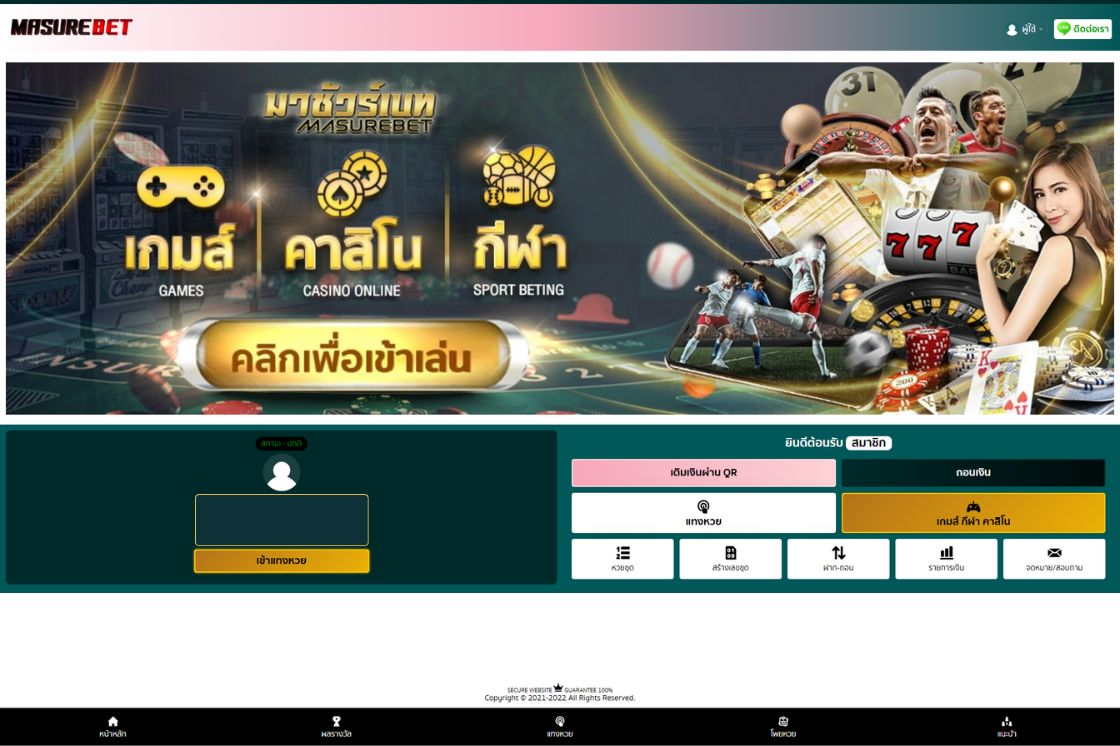

Masurebet

- หวยรัฐบาลพิเศษที่จ่าย 4 ตัวบนถึง 4,000 บาท

- ระบบฝากถอนอัตโนมัติที่กำหนดยอดฝากขั้นต่ำเพียง 20 บาท

- หวยลาวชุดที่จ่ายสูงถึง 130,000 บาท

10 เว็บซื้อหวยออนไลน์ จ่ายจริง เชื่อถือได้

ต่อไปนี้เป็น 10 อันดับเว็บแทงหวยออนไลน์ยอดนิยมประจำปี 2568

- ซื้อหวย365

- 77Lotto

- Huaysod

- Confirm168

- 1000แท้

- Tong998

- ใจดี24

- Lottoone

- Thailotto

- Masurebet

1. ซื้อหวย365

ซื้อหวย365 เป็นเว็บหวยออนไลน์ที่ให้บริการหวยครบวงจร โดดเด่นด้วยความหลากหลายของหวย ทั้ง หวยไทย อย่างหวยรัฐบาล หวยออมสิน หวย ธ.ก.ส. หวยต่างประเทศ อย่างหวยฮานอย หวยลาว หวยมาเลย์ หวยชุด และ หวยหุ้น จากหลายประเทศ รวมถึงหวยยี่กี VIP ที่เปิดให้เล่น 88 รอบต่อวัน พร้อมอัตราจ่ายที่สูงถึง 900 บาท สำหรับ 3 ตัวบน และหวยชุดที่จ่ายสูงสุดถึง 120,000 บาท นอกจากนี้ยังมีระบบฝาก-ถอนที่รวดเร็วและปลอดภัย โดยฝากขั้นต่ำเพียง 20 บาท ถอนขั้นต่ำ 100 บาท และมีระบบ AF ที่ให้ส่วนแบ่งสูงถึง 8% สำหรับหวยต่างประเทศ ยังมีเกมเดิมพันครบวงจรจากค่ายชั้นนำมากมาย

| ข้อดี | ข้อเสีย |

|---|---|

| มีหวยให้เลือกหลากหลาย รวมถึงหวยชุด | ถอนขั้นต่ำค่อนข้างสูงสำหรับบางผู้เล่น (100 บาท) |

| ระบบฝาก-ถอนรวดเร็ว | ไม่มีแอปพลิเคชันสำหรับมือถือ |

2. 77Lotto

Lotto77 เป็นเว็บหวยออนไลน์ที่เปิดให้บริการมายาวนาน โดดเด่นด้วยความหลากหลายของหวยที่ให้บริการ ทั้ง หวยไทย อย่างหวยรัฐบาล หวยออมสิน หวยธกส. หวยต่างประเทศ ทั้งหวยฮานอย หวยลาว หวยมาเลย์ หวยจับยี่กี หวยหุ้น จากหลายประเทศ และ หวยชุด จากหลายประเภท พร้อมให้บริการเกมเดิมพันอีกมากมายจากค่ายชั้นนำ ทั้งเกมคาสิโน เกมสล็อต เกมยิงปลา และพนันกีฬา มีอัตราจ่ายสูงถึง 900 บาท สำหรับหวยรัฐบาลไทย 3 ตัวบน และ 850 บาท สำหรับหวยต่างประเทศ ระบบฝากถอนรวดเร็วภายใน 1-3 นาที ฝากขั้นต่ำเพียง 1 บาท ถอนขั้นต่ำ 300 บาท มีโปรโมชั่นและกิจกรรมหลากหลาย เช่น กงล้อนำโชค เปิดไพ่นำโชค ระบบ Ranking VIP และยังมีระบบแนะนำเพื่อนที่ให้ส่วนแบ่ง 8% จากยอดซื้อหวยของผู้ที่ถูกแนะนำมา

| ข้อดี | ข้อเสีย |

|---|---|

| ฝากขั้นต่ำเพียง 1 บาท | ถอนขั้นต่ำค่อนข้างสูง (300 บาท) |

| มีเกมคาสิโนและกิจกรรมเสริม | อัตราจ่ายบางหวยต่ำกว่าเว็บอื่น |

3. Huaysod

Huaysod เป็นเว็บหวยออนไลน์ยอดนิยมที่โดดเด่นด้วยอัตราจ่ายสูงถึง 950 บาท สำหรับ 3 ตัวบน และมีหวยให้เลือกซื้อหลากหลายประเภท ทั้ง หวยในประเทศ อย่างหวยรัฐบาล หวยออมสิน หวยธกส. หวยต่างประเทศ ที่มีให้เลือกซื้อมากมาย เช่น หวยฮานอย 10 ประเภท หวยลาว 8 ประเภท รวมถึง หวยชุด อย่างหวยฮานอยชุดและหวยลาวชุดที่มีอัตราจ่ายสูงถึง 90,000 บาท สำหรับ 4 ตัวตรง และ หวยหุ้นต่างประเทศ ทั้งแบบปกติและ VIP ที่ครอบคลุมตลาดหุ้นทั่วโลก ระบบเว็บได้มาตรฐาน ใช้งานง่าย รองรับทุกอุปกรณ์ พร้อมระบบออกผลรางวัลที่แม่นยำและรวดเร็ว การสมัครสมาชิกทำได้ง่ายเพียง 4 ขั้นตอนด้วยการยืนยัน OTP ผ่านโทรศัพท์มือถือ นอกจากนี้ยังมีระบบพันธมิตร (Affiliate) ที่ให้ค่าคอมมิชชั่นแก่ผู้ชักชวนลูกค้าใหม่

| ข้อดี | ข้อเสีย |

|---|---|

| รองรับหวยหลายประเทศและหวยชุด | ถอนขั้นต่ำ 300 บาท อาจสูงสำหรับผู้เริ่มต้น |

| ระบบออกผลแม่นยำ รวดเร็ว | ไม่มีแอปพลิเคชันบนมือถือ |

4. Confirm168

Confirm168 เป็นแพลตฟอร์มออนไลน์ที่ให้บริการด้านหวยและเกมพนันหลากหลายประเภท โดดเด่นด้วยการให้บริการหวยที่ได้รับความนิยม ทั้ง หวยไทย ที่มีอัตราจ่ายสูงถึง 1,000 บาท สำหรับ 3 ตัวบน และ หวยฮานอย ที่มีให้เลือกหลากหลายประเภท อาทิ หวยฮานอย VIP หวยฮานอยเช้า หวยฮานอยรอบดึก รวมถึง หวยลาว ที่มีบริการมากถึง 14 ประเภท ทั้งหมดมีอัตราจ่ายที่เท่าเทียมกันคือ 3 ตัวบน จ่าย 1,000 บาท และ 2 ตัวบน/ล่าง จ่าย 100 บาท นอกจากนี้ยังมีระบบฝาก-ถอนที่เป็นมิตรกับผู้เล่น โดยฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 300 บาท พร้อมบริการเกมเสริมอื่นๆ ทั้งคาสิโนสด สล็อต เกมการ์ด เกมยิงปลา และมินิเกม ทำให้ผู้เล่นสามารถเพลิดเพลินกับเกมพนันได้หลากหลายรูปแบบในที่เดียว

| ข้อดี | ข้อเสีย |

|---|---|

| จ่ายสูงถึงบาทละ 1,000 บาท | ถอนขั้นต่ำ 300 บาท |

| หวยลาว-ฮานอยมีหลายประเภท | ไม่มีแอปเฉพาะใช้งานบนมือถือ |

5. 1000แท้

1000แท้ เป็นแพลตฟอร์มหวยออนไลน์ที่ได้รับความนิยมด้วยจุดเด่นด้านอัตราจ่ายที่สูง โดยเฉพาะ 3 ตัวบน ที่จ่ายบาทละ 1,000 บาท และ 4 ตัวบน ที่จ่ายสูงถึง 4,000 บาท พร้อมให้บริการหวยหลากหลายประเภท ทั้ง หวยไทย ที่มีรูปแบบการแทงครบครัน หวยต่างประเทศ อย่างหวยลาว หวยฮานอย หวยมาเลย์ ที่มีอัตราจ่ายใกล้เคียงกัน รวมถึง หวยหุ้น และ หวยยี่กี ที่ออกรางวัลบ่อยครั้ง มีระบบฝาก-ถอนที่เข้าถึงง่าย โดยกำหนดยอดฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 200 บาท เหมาะสำหรับนักเสี่ยงโชคทุกระดับ ที่สามารถเลือกเล่นได้หลากหลายรูปแบบ ทั้งเลขตรง เลขโต๊ด เลขวิ่ง และเลขปัก ตามความถนัดของแต่ละคน

| ข้อดี | ข้อเสีย |

|---|---|

| อัตราจ่ายสูงกว่าหลายเว็บ โดยเฉพาะ 4 ตัวบน | ไม่มีระบบแชทสดช่วยเหลือทันที |

| รองรับหวยยี่กีออกถี่ เหมาะกับคนชอบเล่นถี่ | ไม่มีโปรโมชั่นดึงดูดสำหรับผู้เล่นใหม่ |

6. Tong998

Tong998 เป็นแพลตฟอร์มหวยออนไลน์ครบวงจรที่ให้บริการหลากหลายประเภท ทั้ง หวยไทย ที่มีอัตราจ่ายสูงถึง 1,000 บาท ต่อบาทสำหรับ 3 ตัวบน พร้อมอัตราจ่ายที่น่าสนใจสำหรับรูปแบบการแทงอื่นๆ หวยฮานอย ที่มีให้เลือกถึง 11 ประเภท และ หวยลาว ที่มีให้บริการมากถึง 14 ประเภท ทำให้ผู้เล่นสามารถเสี่ยงโชคได้แทบทุกวัน นอกจากนี้ยังมี หวยหุ้น และ หวยยี่กี ที่มีรอบออกรางวัลถี่มาก โดยเฉพาะจับยี่กีห้านาทีที่มีการออกรางวัลถึง 264 รอบต่อวัน ทุกประเภทหวยมีอัตราจ่ายมาตรฐานเท่ากัน คือ 3 ตัวบนจ่าย 1,000 บาท และ 2 ตัวบน/ล่างจ่าย 100 บาท พร้อมเงื่อนไขการฝากถอนที่เข้าถึงง่าย ฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 300 บาท รวมทั้งยังมีเกมเพิ่มเติมที่หลากหลาย เช่น คาสิโนสด สล็อต เกมการ์ด เกมยิงปลา และมินิเกม

| ข้อดี | ข้อเสีย |

|---|---|

| รองรับหวยยี่กี 264 รอบต่อวัน | ถอนขั้นต่ำเริ่มต้นที่ 300 บาท |

| มีเกมพนันเสริมให้เลือกเล่นครบ | เว็บไซต์ดีไซน์เรียบ ไม่หวือหวา |

7. ใจดี24

ใจดี24 เป็นผู้ให้บริการหวยออนไลน์ยอดนิยมที่โดดเด่นด้วยอัตราจ่ายสูงเป็นพิเศษ โดยเฉพาะสำหรับ 3 ตัวบน ที่จ่ายถึงบาทละ 1,000 บาท และ 4 ตัวบน ที่จ่ายสูงถึง 4,000 บาท มีบริการหวยหลากหลายประเภท ทั้ง หวยไทย ที่เป็นที่นิยม หวยต่างประเทศ อย่างหวยลาว หวยฮานอย หวยมาเลย์ ที่มีอัตราจ่ายเท่ากันที่ 1,000 บาท สำหรับ 3 ตัวบน รวมถึง หวยหุ้น และ หวยยี่กี ที่ออกรางวัลบ่อยครั้ง มีรูปแบบการแทงหลากหลายทั้งแทงเลขตรง เลขโต๊ด เลขวิ่ง และเลขปัก พร้อมระบบฝากถอนที่เข้าถึงง่ายด้วยยอดฝากขั้นต่ำเพียง 50 บาท และถอนขั้นต่ำ 200 บาท ทำให้นักเสี่ยงโชคทุกระดับสามารถเข้าถึงบริการได้

| ข้อดี | ข้อเสีย |

|---|---|

| อัตราจ่ายสูงสุดถึงบาทละ 1,000 และ 4,000 | ไม่มีระบบสมาชิก VIP หรือสะสมแต้ม |

| แทงเลขได้หลายแบบ ทั้งตรง โต๊ด วิ่ง ปัก | ไม่รองรับการสมัครผ่านโซเชียลมีเดีย |

8. Lottoone

Lottoone เป็นแพลตฟอร์มหวยออนไลน์ชั้นนำที่โดดเด่นด้วยความหลากหลายของประเภทหวยที่ให้บริการ ทั้ง หวยรัฐบาล ที่มีอัตราจ่ายสูงถึง 950 บาท สำหรับ 3 ตัวบน หวยต่างประเทศ อย่างหวยลาว หวยฮานอย และหวยมาเลย์ ที่มีอัตราจ่ายสูงถึง 900 บาท รวมถึง หวยยี่กี ที่มีหลากหลายรูปแบบทั้งแบบ 88 รอบ และแบบ 5 นาที (264 รอบต่อวัน) จากหลายแบรนด์ เช่น ยี่กี Huay, ยี่กี LTO และยี่กี ชัดเจน นอกจากนี้ยังมี หวยเลขชุด ที่มีโอกาสรับรางวัลสูงถึง 120,000 บาท พร้อมระบบการทำธุรกรรมที่เป็นมิตรกับผู้ใช้ โดยกำหนดยอดฝากขั้นต่ำที่ 100 บาท และถอนขั้นต่ำ 200 บาท มีโปรโมชั่นโบนัสประจำวันและวงล้อมหาสนุกที่มีรางวัลสูงสุดถึง 10,000 บาท ช่วยเพิ่มความตื่นเต้นในการเล่น

| ข้อดี | ข้อเสีย |

|---|---|

| มีระบบหวยยี่กีหลายแบรนด์ในที่เดียว | ฝากขั้นต่ำค่อนข้างสูง (100 บาท) |

| มีวงล้อมหาสนุกแจกโบนัสทุกวัน | ไม่มีระบบ Affiliate แนะนำเพื่อน |

9. Thailotto

Thailotto เป็นเว็บหวยออนไลน์ยอดนิยมที่ให้บริการหวยหลากหลายประเภท ทั้ง หวยไทย อย่างหวยรัฐบาล หวยธกส หวยออมสิน หวยหุ้นไทย หวยต่างประเทศ ทั้งหวยมาเลย์ หวยลาว หวยฮานอย และ หวยหุ้นต่างประเทศ มากกว่า 12 ประเภท รวมถึง หวยลาวชุด โดยมีอัตราจ่ายสูงสุดสำหรับหวยรัฐบาลไทยและหวยต่างประเทศที่ 800 บาท และหวยลาวชุดที่จ่ายสูงถึง 120,000 บาท มีระบบการสมัครสมาชิกที่ง่ายดายเพียง 5 ขั้นตอน พร้อมโปรโมชั่นสำหรับสมาชิกใหม่ที่ฝากเงินครั้งแรก โดยได้รับโบนัสสูงสุดถึง 100% นอกจากนี้ยังมีกิจกรรมพิเศษอย่างหวยแจ๊คพอตที่ลุ้นรับเงินรางวัลสูงถึง 400,000 บาท และวงล้อนำโชคที่มีเงินรางวัลสูงสุด 100,000 บาท ระบบฝาก-ถอนเข้าถึงง่ายด้วยการฝากขั้นต่ำเพียง 50 บาท ถอนขั้นต่ำ 500 บาท และมีระบบแนะนำเพื่อนที่ให้ส่วนแบ่งค่าแนะนำสูงสุดถึง 8%

| ข้อดี | ข้อเสีย |

|---|---|

| มีหวยแจ็คพอตและกิจกรรมแจกเงินสด | อัตราจ่ายหวยรัฐบาลต่ำกว่าเว็บอื่นเล็กน้อย |

| ระบบสมัครง่ายและมีโบนัสสมาชิกใหม่ | ถอนขั้นต่ำสูง (500 บาท) |

10. Masurebet

Masurebet เป็นเว็บหวยออนไลน์ยอดนิยมที่รวบรวมหวยทุกประเภททั้งในและต่างประเทศไว้ในเว็บเดียว โดดเด่นด้วยอัตราจ่ายสูงสุดถึง 970 บาท พร้อมระบบฝากถอนอัตโนมัติที่กำหนดยอดฝากขั้นต่ำเพียง 20 บาท และถอนขั้นต่ำ 100 บาท มีบริการ หวยในประเทศ ทั้งหวยรัฐบาล หวยออมสิน หวยธกส. ที่จ่าย 3 ตัวบนที่ 1,000 บาท และหวยรัฐบาลพิเศษที่จ่าย 4 ตัวบนถึง 4,000 บาท หวยต่างประเทศ มีให้เลือกมากมาย ทั้งหวยฮานอยที่มีถึง 14 ประเภท อย่างหวยฮานอย VIP หวยฮานอยสตาร์ หวยฮานอย TV และหวยฮานอยชุดที่จ่ายสูงถึง 90,000 บาท หวยลาวที่มี 15 ประเภท อย่างหวยลาวสตาร์ หวยลาว VIP หวยลาวพิเศษ และหวยลาวชุดที่จ่ายสูงถึง 130,000 บาท รวมถึง หวยหุ้นต่างประเทศ ทั้งแบบปกติและ VIP ที่สามารถเลือกซื้อได้หลายประเภท

| ข้อดี | ข้อเสีย |

|---|---|

| หวยลาว-ฮานอยให้เลือกมากกว่า 25 ประเภท | ยังไม่มีระบบสะสมคะแนนหรือ VIP |

| รองรับหวย 4 ตัวบนที่จ่ายสูงถึง 4,000 | อินเทอร์เฟซดูเรียบ อาจไม่ทันสมัย |

รูปแบบการซื้อของหวยออนไลน์

หวยออนไลน์ถือเป็นหนึ่งในการเสี่ยงโชคได้รับความนิยมอย่างมากในปัจจุบัน ทำให้มีผู้เล่นมือใหม่หรือผู้ที่เคยซื้อหวยใต้ดินมาก่อน หันมาเลือกซื้อหวยออนไลน์กันมากขั้น โดยจะมีจุดเด่นทั้งในเรื่องของอัตราจ่ายที่สูง ความสะดวกในการซื้อ เนื่องจากมรีหวยออนไลน์ให้เลือกซื้อหลากหลายประเภท ดังนั้นผู้เล่นก็ควรที่จะหาข้อมูลเกี่ยวกับหวยออนไลน์ประเภทนั้นให้ดีก่อนทำการเสี่ยงโชค โดยรูปแบบการซื้อของหวยออนไลน์แต่ละประเภทนั้นก็จะมีความคล้ายกัน หวยออนไลน์ส่วนใหญ่จะมีรูปแบบการซื้อดังนี้

- 3 ตัวบน

- 3 ตัวโต๊ด

- 2 ตัวบน

- 2 ตัวล่าง

- วิ่งบน

- วิ่งล่าง

นอกจากนั้นจะยังมีในส่วนของหวยชุด ที่จะมีรูปแบบการซื้อที่คล้ายกันกับการซื้อสลากกินแบ่งรัฐบาล เช่น หวยลาวชุด หวยฮานอยชุด หวยมาเลย์ชุด หวยรัฐบาลชุด ซึ่งจะขึ้นอยู่กับเว็บหวยออนไลน์ที่เลือกซื้อด้วยว่ามีหวยชุดประเภทใดให้เลือกซื้อ

หวยออนไลน์แต่ละประเภทที่มีให้เลือกซื้อ

เว็บหวยออนไลน์ส่วนใหญ่นั้น มักจะมีหวยออนไลน์ให้เลือกซื้อหลากหลายประเภท ซึ่งแต่ละเว็บนั้นก็จะมีให้เลือกซื้อแตกต่างกันออกไป บางเว็บก็อาจจะมีประเภทหวยออนไลน์พื้นฐานที่เว็บส่วนใหญ่มี แต่บางเว็บก็จะมีประเภทของหวยออนไลน์อื่นๆ ให้เลือกซื้อด้วยเช่นกัน เว็บหวยออนไลน์ส่วนใหญ่มันจะแยกหมวดหมู่ของหวยออนไลน์ดังนี้

- หวยไทย

หวยรัฐบาล, หวยออมสิน, หวยธกส. - หวยต่างประเทศ

หวยฮานอย, หวยลาว, หวยมาเลย์ - หวยหุ้น / หวยหุ้น VIP

หวยหุ้นจีน, หวยหุ้นนิเคอิ, หวยหุ้นฮั่งเส็ง, หวยหุ้นเกาหลี, หวยหุ้นสิงคโปร์, หวยหุ้นเยอรมัน, หวยหุ้นอินเดีย, หวยหุ้นอังกฤษ, หวยหุ้นอียิปต์, หวยหุ้นไต้หวัน - 2 ตัวล่าง

- หวยยี่กี

หวยยี่กี (88 รอบ), หวยยี่กี (264 รอบ)

สำหรับหวยออนไลน์ประเภทอื่นๆ หรือหวยแปลกๆที่มีให้เลือกซื้อ ส่วนใหญ่แล้วจะเป็น หวยลาวและหวยฮานอย เช่น หวยลาวร่วมใจ, หวยลาววิลล่า, หวยลาวนคร, หวยลาวจำปา, หวยฮานอยท้องถิ่น, หวยฮานอยเดย์, หวยฮานอย (Extra) ซึ่งจะเป็นหวยที่มีให้เลือกซื้อหลากหลายประเภทมากๆ

สิ่งที่มีให้เลือกเล่นนอกจากหวยออนไลน์

นอกจากจะมีหวยออนไลน์ให้เลือกซื้อแล้ว เว็บหวยออนไลน์ส่วนใหญ่มักจะมีเกมเดิมพันอื่นๆ ให้ผู้เล่นได้เลือกเสี่ยงโชคได้ด้วย โดยเว็บหวยออนไลน์หลายๆเว็บ มักจะมีเกมเดิมพันให้ผู้เล่นนั้นได้เลือกเสี่ยงโชคกันได้เพิ่มด้วย ซึ่งหลักแล้วเว็บหวยออนไลน์จะมีเกมเดิมพันให้เลือกเล่นดังนี้เกมคาสิโนออนไลน์ เกมสล็อตออนไลน์ กีฬาออนไลน์ มินิเกม, เกมหัวก้อย, เกมสูงต่ำ, เกมเป่ายิงฉุบ

- เกมคาสิโนออนไลน์

- เกมสล็อตออนไลน์

- กีฬาออนไลน์

- มินิเกม, เกมหัวก้อย, เกมสูงต่ำ, เกมเป่ายิงฉุบ

ซึ่งเว็บหวยออนไลน์ที่มีเกมเดิมพันให้เลือกเล่นนั้น จะขึ้นอยู่กับเว็บที่ผู้เล่นนั้นเลือก บางเว็บก็อาจจะไม่มีเกมเดิมพันให้เลือกเล่นเลย หรือบางเว็บก็อาจจะมีเพียง มินิเกม ให้เลือกเล่นเท่านั้น แน่นอนว่าการเข้าเล่นเกมเดิมพันนั้น ผู้เล่นไม่จำเป็นต้องทำการโยกเงินไปเล่น สามารถกดเข้าเดิมพันได้เลย โดยเกมส่วนใหญ่จะสามารถเริ่มเดิมพันได้ตั้งแต่ 5 บาทขึ้นไป

คำถามที่พบบ่อย (FAQs)

- ผู้เล่นใหม่จะเริ่มซื้อหวยออนไลน์ได้อย่างไร?

สำหรับผู้เล่นใหม่ สามารถเริ่มต้นได้ง่ายๆเพียงไม่กี่ขั้นตอนเท่านั้น เริ่มจากเลือกเว็บหวยออนไลน์ สมัครสมาชิก เริ่มฝากเงินเพื่อใช้ซื้อหวย จากนั้นก็สามารถทำการเสี่ยงโชคหวยออนไลน์ได้เลย

- หากต้องการซื้อหวยออนไลน์เป็นประจำควรเลือกซื้อประเภทไหนดี?

หากเป็นผู้ที่ชื่นชอบการเสี่ยงโชคเป็นประจำทุกวัน แนะนำ หวยฮานอย, หวยลาว, หวยยี่กี หลายออนไลน์เหล่านี้มักจะมีให้เลือกซื้อหลายประเภท และมีการออกรางวัลเป็นประจำ

- หวยออนไลน์ประเภทใดได้รับความนิยมสูง?ผู้เล่นส่วนใหญ่มักจะชื่นชอบในการซื้อหวยรัฐบาล แต่จะออกรางวัลเพียงแค่เดือนละ 2 ครั้งเท่านั้น หวยลาว ถือเป็นหนึ่งในหวยออนไลน์ที่ได้รับความนิยมเป็นอย่างมาก สำหรับนักเสี่ยงโชคชาวไทย เพราะจะมีอัตราจ่ายที่สูง และสามารถเสี่ยงโชคได้เป็นประจำ

- หวยรัฐบาลออนไลน์ต่างจากหวยใต้ดินยังไง?หวยรัฐบาลออนไลน์กับหวยใต้ดิน จะมีรูปแบบการซื้อที่คล้ายกัน จะแตกต่างกันเพียงแค่ หวยรัฐบาลออนไลน์อัตราจ่ายสูงกว่า สามารถซื้อได้ง่ายและสะดวกสบายมากกว่าการซื้อหวยใต้ดิน จึงทำให้หวยรัฐบาลออนไลน์ได้รับความนิยมเป็นอย่างมากในปัจจุบัน